Growth has never been more important to our clients as they navigate rapidly changing political, economic and technological currents.

Our clients need to respond to change, make data-driven strategic decisions at pace, design or refine their products and then build demand whilst explaining their plans to stakeholders. Our decentralised, diversified network of specialist consultants means that Next 15 is uniquely placed to help.

This Annual Report sets out how we continue to evolve Next 15 to be the go-to adviser for our clients, and how our structure and skills have allowed us to emerge from a challenging year better and stronger.

Key numbers for 2024.

4,340

Employees

(2023: 4,079)

42

Offices

(2023: 43)

15

Countries

(2023: 15)

7

Acquisitions

(2023: 7)

Financial highlights.

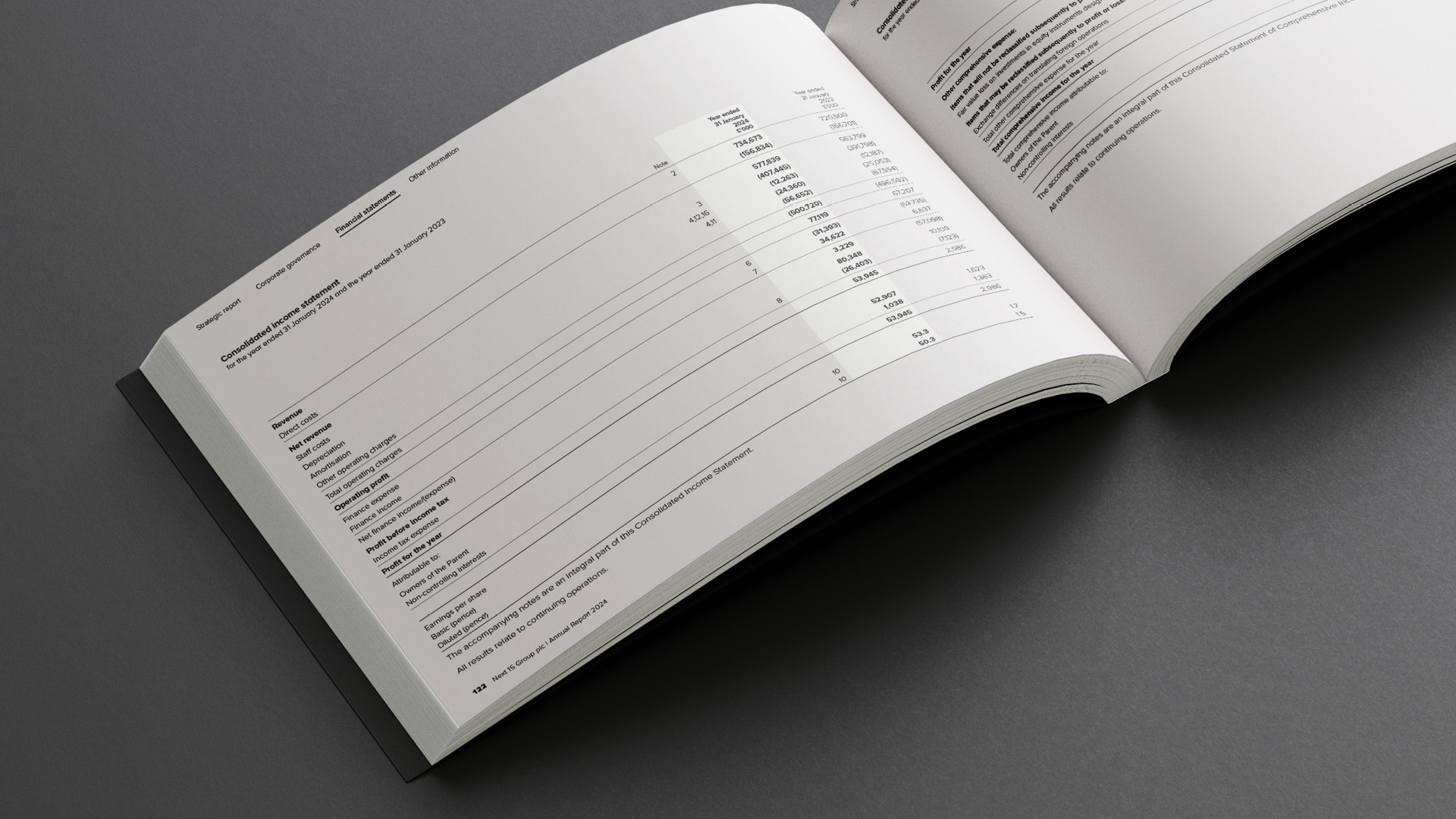

1 For FY24 statutory diluted earnings per share is 50.3p (FY23: 1.5p) and statutory profit before tax is £80.3m (FY23: £10.1m). These measures have not been graphically represented as the movements are not meaningful.

Alternative Performance Measures

The report provides alternative performance measures (‘APMs’) which are not defined or specified under IFRS.

♦ Measures with this symbol are defined and their use explained in the Glossary section on page 200 of the Annual Report and Accounts 2024.

Build our growth consultancy model.

Our priorities.

Growth has never been more important to our clients, whether that’s to deliver financial returns or societal outcomes. Growth is what Next 15 offers and we continue to evolve our Group to offer clients a leading-edge service. We will continue to invest in talented, entrepreneur-led businesses that bring new capabilities that our customers need. Our focus remains primarily UK and US.

Use the power of Next 15.

Our priorities.

We will use our shared insight, scale and capabilities to better serve customers without losing our Group’s entrepreneurial spirit or deep specialist expertise. We invest in AI-driven capabilities, tech, data and products that our businesses can share.

Focus on doing better.

Our priorities.

Our values are important to us. We want to work with customers, suppliers and staff who share them. More so than ever, we choose our work carefully, look to maximise the positive impact that our work has, and are not afraid to say ‘no’ to work that is financially positive but planet or people negative.

Celebrate and develop our people.

Our priorities.

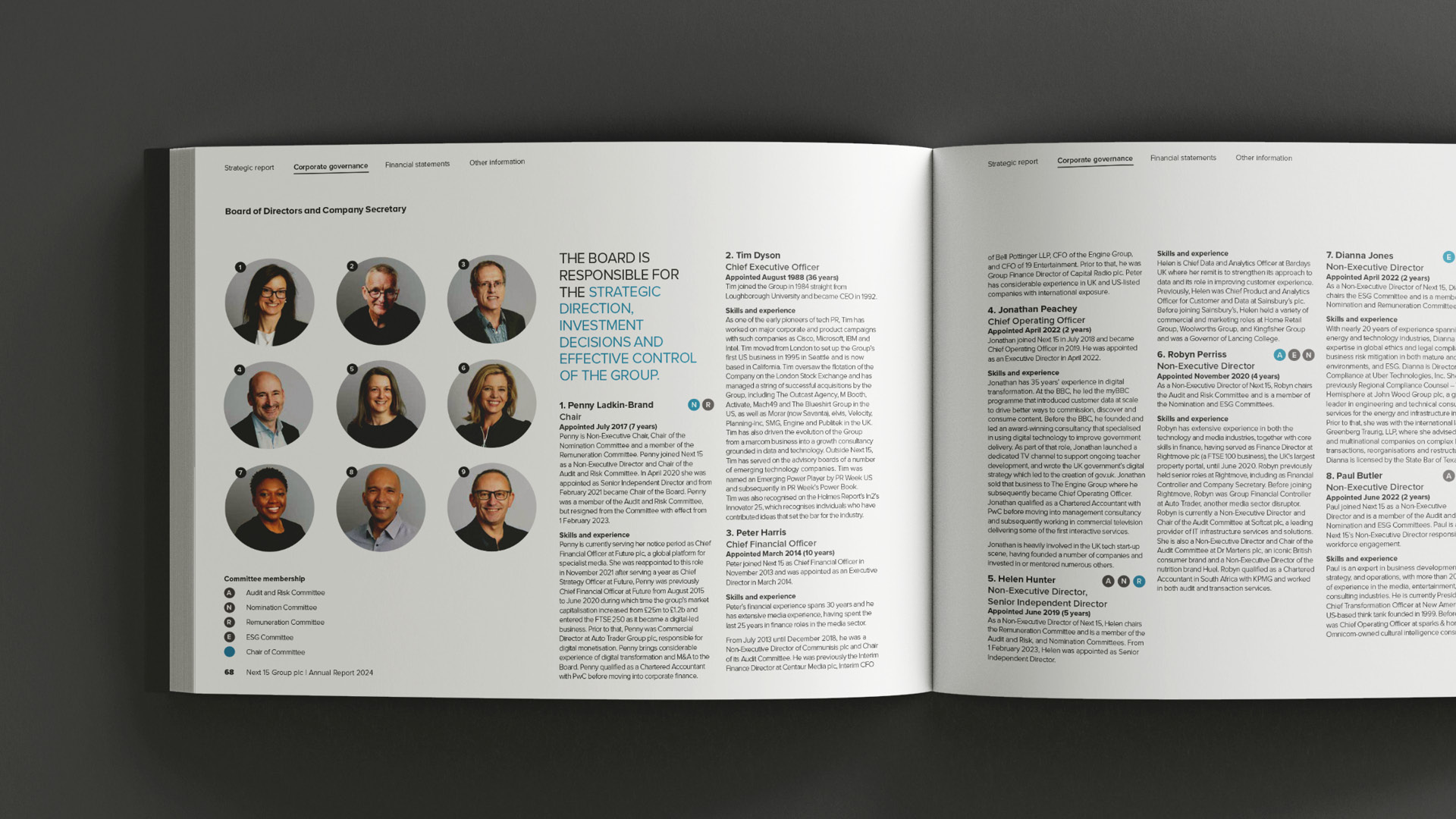

We are a group of businesses built by the talent of our people. We use our growth consultancy model internally to attract, develop and retain the best staff. When we acquire new businesses we trust entrepreneurial talent to drive their own businesses and consult with us, and provide them with the freedom to innovate whilst maintaining strong governance.

Our markets.

Customer Insight.

2022 market size:

£155.73b

CAGR growth 2022–27:

14.07%

FY24 Next 15 net revenue:

£57.5m

2022 breakdown

(growth 2022–27 CAGR %)

Market research:

£65.9b (3.4%)

Data management:

£13.94b (15.8%)

Data analytics and implementation:

£28.71b (23.2%)

Customer Relationship Management implementation:

£47.18b (13.9%)

Customer Engagement.

2022 market size:

£345.71b

CAGR growth 2022–27:

16.15%

FY24 Next 15 net revenue:

£263.1m

2022 breakdown

(growth 2022–27 CAGR %)

Customer experience:

£12.19b (16.6%)

Content, communications and creative:

£336.98b (16.9%)

Customer Delivery.

2022 market size:

£290.46b

CAGR growth 2022–27:

13.76%

FY24 Next 15 net revenue:

£107.6m

2022 breakdown

(growth 2022–27 CAGR %)

E-commerce implementation:

£5.78b (15.3%)

Search Engine Optimisation:

£55.54b (8.4%)

Media buying and planning:

£61.68b (4%)

Social media management:

£14.30b (24.2%)

Lead generation:

£153.16b (16.9%)

Business Transformation.

2022 market size:

£1,329.07b

CAGR growth 2022–27:

10.29%

FY24 Next 15 net revenue:

£149.6m

2022 breakdown

(growth 2022–27 CAGR %)

Strategy consulting:

(inc Environmental, Social and Governance and People Change Management)

£159.22b (6.36%)

Digital transformation:

£49.28b (13.31%)

Big data and analytics:

£111.93b (12.8%)

Other:

£952.3b (8.68%)

2022 data has been used as a baseline to ensure a uniform comparison across the data given an absence of publicly published data for 2023 in several of the above capabilities.