Chair’s Corporate Governance Statement.

The Directors recognise that shareholders look to the Board to deliver growth and long-term shareholder value and I recognise that an efficient, effective and dynamic governance framework is crucial to achieving this.

This year, the Board’s activities have focused on the long-term strategic direction and how we best govern ourselves to build sustainable growth and shareholder returns. We held a strategy day in London, which provided an opportunity to discuss the strategic direction of the Group and to share information and ideas with our brand leaders. Much of the focus of the day was on the opportunities and investments the Group is making, particularly in artificial intelligence. These opportunities are helping the Group evolve in a way that simplifies and strengthens the business while retaining the specialist model that sets us apart.

On 6 September 2024, the Company announced the loss of the Group’s largest client following the non-renewal of the contract. Given the impact of this news, the Board commissioned an internal review of the matters leading up to the client loss and whether lessons can be learned on portfolio company governance.

We are committed to ensuring that the Board continues to be diverse and dynamic, and we regularly review the composition of it to ensure it maintains a balance of skills, experience and diversity to reflect the current and expected future needs of the business and to determine how the strategy and business should evolve. Over the past few months we have, in conjunction with our existing Non-Executive Directors, discussed how best to resize and refresh the Board composition for the next stage of the Next 15 journey, recognising that today the Group is at a different juncture in terms of market capitalisation, proportion of US revenues and strategic growth drivers.

On 30 January 2025 we announced that Peter Harris had confirmed his intention to step down from the Board and his role as CFO. We further announced on 26 March 2025, that Mickey Kalifa will join the Board as Peter’s replacement from 1 June 2025. Mickey is a Chartered Accountant with experience across the media, technology and gaming sectors. Peter is continuing as CFO and is fully supporting the Board until Mickey joins.

Mark Astaire joined the Board on 1 February 2025 as an independent Non-Executive Director. Mark brings with him over 35 years of investment banking experience. We have also announced the appointment of Samantha Wren as a further independent Non-Executive Director with effect from 1 June 2025. Samantha has extensive accounting and auditing experience and has worked with founders in a portfolio company environment.

We believe these board appointments ensure we have the appropriate skillset to provide support, challenge and leadership for the business going forward.

I would like to extend my thanks to Helen Hunter, Robyn Perriss and Dianna Jones who will be stepping down as Board directors at the next AGM and am grateful for their strong collective contributions at both a Board level and within the business functions that their respective committees have supported.

As Chair I am responsible for leading the Board and for its governance of the Group, and with the support of the Company Secretary work to ensure continual improvements to the Group’s governance in order to promote its continued long-term success.

We continue to welcome dialogue and feedback from our shareholders at all times.

Penny Ladkin-Brand

Chair

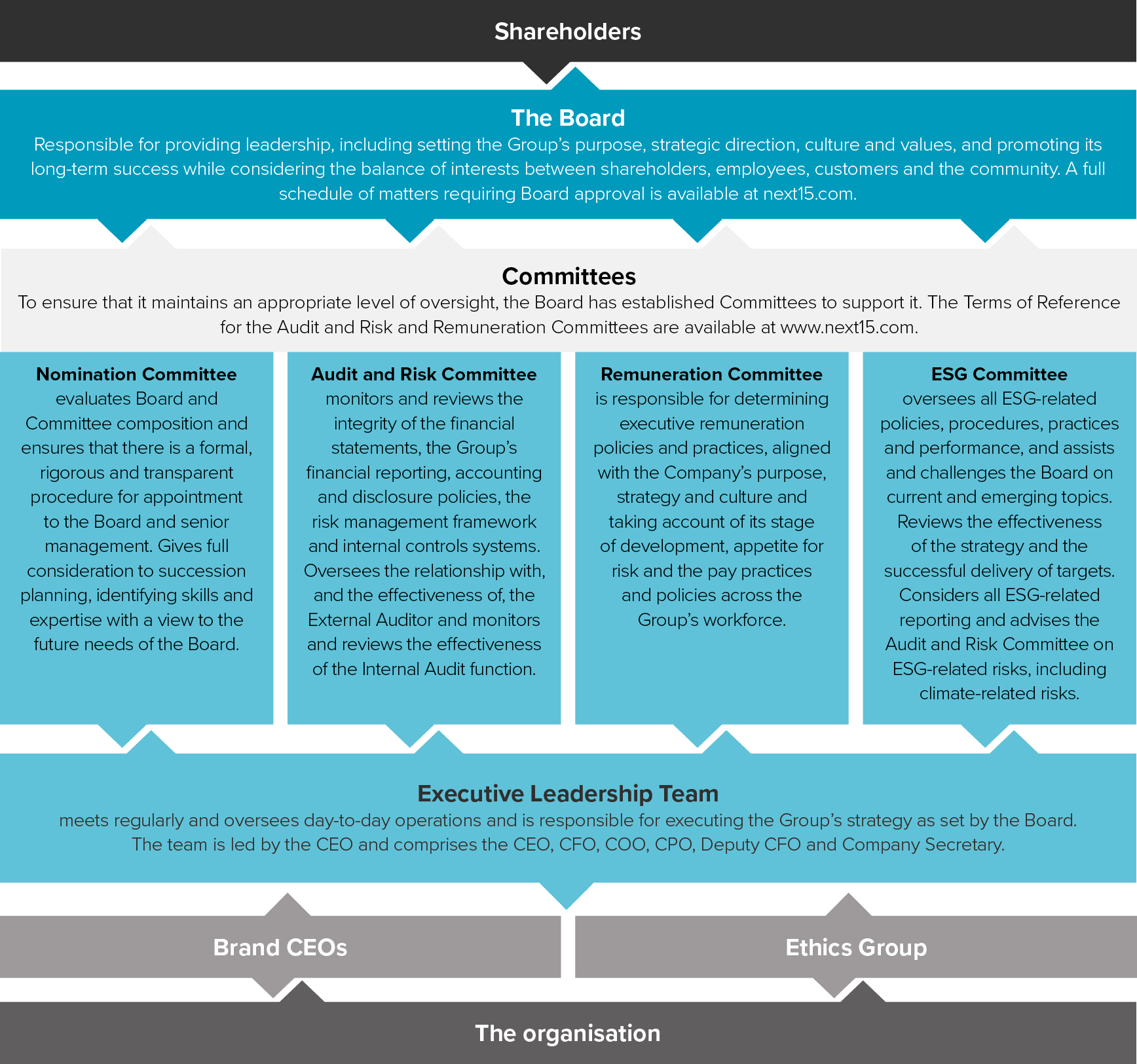

Board and Committees.

The Quoted Companies Alliance’s Ten Principles of Corporate Governance.

Our approach to risk management is set out on page 52 of our Annual Report and Accounts 2025, and the principal risks to our business, and the actions we have taken to mitigate them, are set out on pages 55 to 61 of our Annual Report and Accounts 2025.

The Board is responsible for providing leadership, including setting the strategic direction, Group’s purpose and values, and promoting its long‑term success.

On 30 January 2025 we announced that Peter Harris had confirmed his intention to step down from the Board and his role as CFO. We further announced on 26 March 2025, that Mickey Kalifa will join the Board as Peter’s replacement from 1 June 2025. Mickey is a Chartered Accountant with experience across the media, technology and gaming sectors. Peter is continuing as CFO and is fully supporting the Board until Mickey joins.

Mark Astaire joined the Board on 1 February 2025 as an independent Non-Executive Director. Mark brings with him over 35 years of investment banking experience. We have also announced the appointment of Samantha Wren as a further independent Non-Executive Director with effect from 1 June 2025. Samantha has extensive accounting and auditing experience and has worked with founders in a portfolio company environment.

Biographies of each of the Board Directors, including the Committees on which they serve and chair, are on pages 62 and 63 of the Annual Report and Accounts 2025.

The Board is satisfied that, between the Directors, it has an effective and appropriate balance of skills and knowledge, including a range of financial, commercial and entrepreneurial experience. The Board is also satisfied that it has a suitable balance between independence (of character and judgement) and knowledge of the Group to enable it to discharge its duties and responsibilities effectively. The Non-Executive Directors are considered to be independent. No single Director is dominant in the decision-making process. The Directors have complementary skills and experience in terms of sectors, geography and diversity.

The performance of the Board and its Committees is key to successfully leading the Company to follow its strategic direction. Regular monitoring and reviews are important factors to facilitate and improve the effectiveness of the Board and its Committees. It is also a valuable feedback mechanism for improving effectiveness and maximising strengths, and highlighting areas for further development. Due to changes to the Board, set out on page 67 of the Annual Report and Accounts 2025, the Directors decided to postpone the usual annual Board evaluation process until later in 2025 to allow the new Executive and Non-Executive Directors to be part of the process.

Following the loss of Mach49’s largest client as announced on 6 September 2024, the Board instructed an internal review of the matters leading up to the client loss and a review of brand governance led by the Legal and Compliance functions. The report highlighted that the Company had some good processes in place but recommended some further actions to improve and formalise governance of our brands such as putting in place a Group Code of Conduct, having more formal brand management meetings and ensuring Next 15 Directors build relationships with key clients the brands.

We have a strong corporate culture based on entrepreneurial spirit, taking personal responsibility and treating all stakeholders fairly and equitably. Businesses within the Group are given a high degree of autonomy in line with the Group’s emphasis on personal responsibility, with the centre acting as enablers and teachers. However, the Board and its Committees set a high standard for ethical behaviour and ensure the Group complies with applicable laws and regulations, and the Executive Team works to embed a corporate conscience that runs throughout Group initiatives and practices.

The Board monitors the culture of the Group through periodic updates on people, culture, inclusivity and talent provided by the Group Chief People Officer through monitoring exercises such as staff surveys, employee listening sessions and feedback from Paul Butler as the Board’s workforce engagement representative.

The Board’s structures and processes are set out in detail on pages 65 to 72 of the Annual Report and Accounts 2025.

Matters Reserved for the Board are available here.

The Terms of Reference for the Audit and Risk Committee are available here.

The Terms of Reference for the Remuneration Committee are available here.

s.172 Statement.

Under s172(1) of the Companies Act 2006 (‘s172’), the Directors of the Company are obligated to act in the way they consider would be most likely to promote the success of the Company for the benefit of its members as a whole (its stakeholders including shareholders).

Ready when you are.

You don’t need a tightly defined brief to tap into the Next 15 network. Just talk to our Growth Team. They’ll know exactly who to bring into the room.